A diversified, low-cost and efficient portfolio of ETFs. Built just for you.

Low-cost high-efficiency investing with a robo-advisor

To be a successful investor you need the right portfolio. One that holds a strategic mix of assets and can be adjusted and rebalanced as markets or your needs change. With Qtrade Guided Portfolios you get a low-cost, diversified and efficient investment portfolio built for your needs.

Qtrade Guided Portfolios

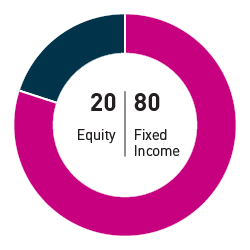

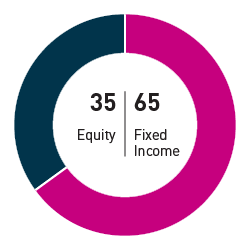

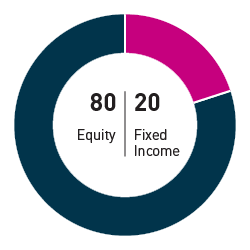

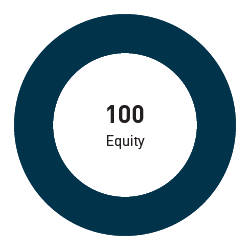

Our Qtrade Guided Portfolios are managed by a robo-advisor that you can be confident in because it builds a portfolio with your goals and risk tolerance in mind. If you’re focused on long-term growth, then your portfolio will hold more stocks. If you’re looking to play it safe and generate consistent income, then your portfolio will hold more bonds and fixed income securities. Or a blend of both if you prefer a more balanced approach. No matter what type of investor you are, each portfolio is optimized to deliver consistent performance while controlling risk.

The art and science of achieving balance

As the time passes, the underlying funds that make up your portfolio will change in value. To make sure that your portfolio continues to have the right asset mix for you, it will periodically need re-balancing. To achieve this balance, some funds will be sold and others will be purchased. Luckily, with Qtrade Guided Portfolios, the invisible hand of our robo-advisor works to put your portfolio back to the right balance you started out with, so you continue to meet your investment goals.

The building blocks of a Guided Portfolio

Here is a list of ETFs that we have carefully selected to use as building blocks for our ETF Portfolios (note that our Responsible Investing Portfolios use different funds). These funds have been chosen because they provide exposure to a variety of specific markets and asset types while offering competitive management fees that help keep your costs low.

- FlexShares STOXX Global Broad Infrastructure Index ETF (NFRA)

- iShares Core S&P Total U.S. Stock Market ETF (ITOT)

- iShares Core MSCI Total International Stock ETF (IXUS)

- iShares Core MSCI Emerging Markets ETF (IEMG)

- iShares Core MSCI EAFE IMI Index ETF (XEF)

- iShares Global REIT ETF (REET)

- Vanguard Canadian Aggregate Bond Index ETF (VAB)

- Vanguard FTSE Canada All Cap Index ETF (VCN)

- Vanguard U.S. Aggregate Bond Index ETF (CAD-hedged) (VBU)

- Vanguard Global ex-U.S. Aggregate Bond Index ETF (CAD-hedged) (VBG)

The cost of a guided portfolio

One of the key benefits of using Qtrade Guided Portfolios is minimizing your costs. We believe that the less money you spend on investing, the better your returns will be over time so you can reach your investment goals faster. We help minimize your costs by selecting low-cost ETFs so that the average blended Management Expense Ratio (MER) is generally less than 0.15% of the value of the account.

With Qtrade Guided Portfolios, you pay a single low management fee once per quarter. You won’t pay any management fees in your first calendar quarter either. And if you’ve got multiple family members in your household with Qtrade Guided Portfolios, we’ll group all of the accounts together to ensure you get the lowest rate possible.

For more detailed pricing information see our pricing page.

You can build a Qtrade Guided Portfolio with any amount

plus getting started is fast and easy!

Complete the simple goal-based questionnaire.

Open and fund your account within minutes

Start investing in your new portfolio.