Concerned about volatility? Dollar-cost averaging may mitigate risk and enhance returns

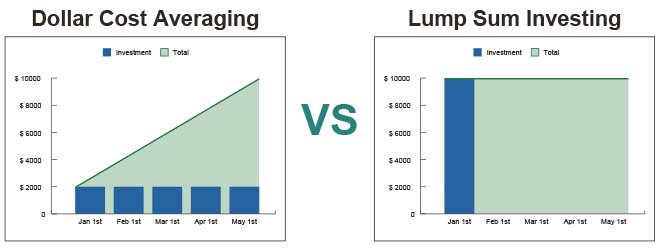

So you’ve earmarked some money to invest, but you’re now concerned that markets may be headed for a bumpy ride? To help alleviate some of your concerns, you may want to consider using a strategy known as dollar-cost averaging (DCA), which could help take advantage of market dips. This strategy involves investing smaller amounts over a longer period of time. You invest a pre-determined amount on a set schedule—say, every month or every quarter— regardless of the security price.

The rationale behind DCA is that you will naturally purchase more shares when prices are lower and fewer shares when prices are higher. If the markets dip, you’ll be investing when securities are more attractively priced. If markets rise, you space out your purchase price over time so that you’re not necessarily investing all your money when prices are at their peak.

As an example, let’s say you want to invest $10,000 in a particular stock, but you’re worried about short-term market volatility. So, you decide to dollar-cost average into that investment. You break up the total into five equal portions of $2,000, which you will invest on the same day over each of the next five months, regardless of the price on that day. There are many scenarios that could play out, but let’s imagine one where the price of the stock drops but begins to rebound.

| Date | Share Price | Shares Bought | Cost |

|---|---|---|---|

| January 1 | $50 | 40 | $2,000 |

| February 1 | $40 | 50 | $2,000 |

| March 1 | $20 | 100 | $2,000 |

| April 1 | $25 | 80 | $2,000 |

| May 1 | $40 | 50 | $2,000 |

| Total | 320 | $10,000 | |

| Average Price Per Share | $35 | Market value on May 1 | $12,800 |

Note: This is a simplified example that does not include trading fees

As the table shows, in this scenario, DCA was a winning strategy. At the end of the five-month period, the market value of your position is 28 percent higher than the amount you invested. This is despite the fact that the stock price at the beginning of May is 20 percent lower than when you started buying it in January.

Benefits of a DCA approach

A gradual investment approach can be favourable in volatile markets, or when a bull market is running out of steam. Consider the scenario above: if you invested the whole $10,000 on January 1 when the stock price was $50, your 200 shares would be worth $8,000 on May 1, an unrealized loss of $2,000. Compare that to the gain of $2,800 when the money is invested gradually.

Another advantage of DCA is that it removes the guesswork and worry of choosing the best time to enter the market. Ideally, you always want to “buy low,” but the inherent unpredictability of markets makes it impossible to know for sure if your timing is right. A DCA strategy can help you solve the dilemma of timing the market. By making regular investments over time, you base your returns on the overall trend as opposed to the specific entry price.

Potential downsides of DCA

When markets are steadily rising, a DCA strategy will not produce the best outcome. In a market rally, you’re better off getting in early with a lump-sum investment and gaining exposure to the upward trend right away. However, timing is pivotal in the case of lump-sum investing. You wouldn’t want to invest a lump sum just before a prolonged market decline.

Overall, your outlook for the markets and your risk appetite will determine what strategy is a good fit for you. If you’re concerned about the potential for a downturn, market correction or prolonged period of volatility, DCA can be an effective way to mitigate risk. If you expect markets to rise, you might prefer to invest a larger sum, sooner.

A final word: if you have a long time-horizon, you should also ask yourself how appropriate it is to worry about short-term market volatility. Generally, the more time you expect to remain invested, the less important your entry point becomes. Over long timeframes, say ten years or more, your investment has lots of time to recover from any near-term drop.

There are several ways to approach DCA, the most common is to set up recurring or one-off contributions and set a date to place a trade each month. Qtrade Guided Portfolios offers a range of registered account types that can help you set up your contributions.

To find out more about regular contribution plans with Qtrade Guided Portfolios, speak to one of our knowledgeable investment representatives.

Or you can set up a recurring contributions plan to invest regularly when you open an account with Qtrade Guided Portfolios.

Resources:

Chen, James. “Dollar-Cost Averaging (DCA).” Investopedia. Nov 1, 2018. https://www.investopedia.com/terms/d/dollarcostaveraging.asp

“How to invest a lump sum of money.” The Vanguard Group Inc. https://investor.vanguard.com/investing/online-trading/invest-lump-sum